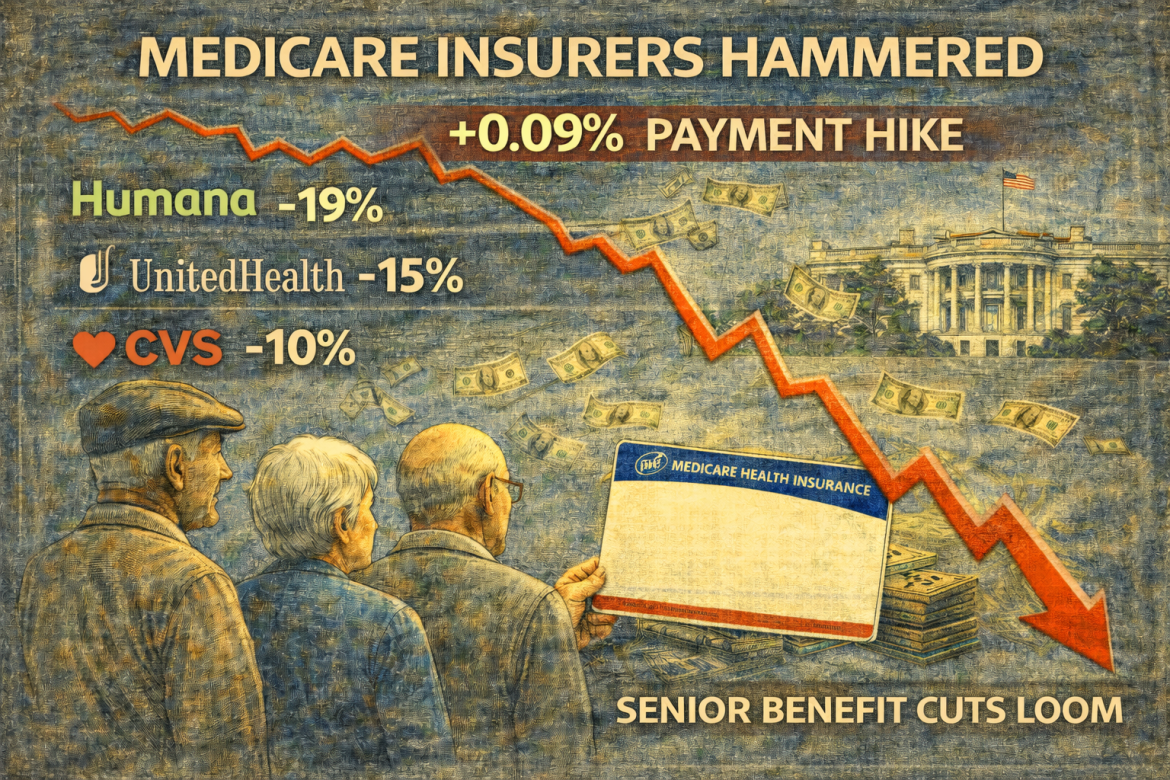

The Trump administration delivered a stunning blow to health insurers, proposing a near-flat 0.09% payment increase for Medicare Advantage plans next year, far below Wall Street’s expectations of 4 to 6%.

The decision triggered an immediate stock market rout: Humana plunged 13 to 20%, UnitedHealth and CVS each fell roughly 10 to 19%, erasing approximately $80 billion in combined market value.

Industry groups immediately warned that 35 million seniors face potential benefit cuts when they renew coverage in October 2026.

The rate shock is not just a number.

It represents roughly $700 million spread across the entire Medicare Advantage insurance industry for 2027, compared to $25 billion in additional funding for 2026.

The flat rate shock: Why 0.09% doesn’t keep pace

Behind the 0.09% headline sits a brutal mathematical reality.

The Centers for Medicare & Medicaid Services (CMS) projected underlying medical costs will grow 4.97% in 2027.

But plans will receive only 0.09% in revenue growth.

The American Hospital Association’s health insurance lobby, AHIP, laid out the stakes clearly:

Flat program funding at a time of sharply rising medical costs will impact seniors’ coverage. If finalized, this proposal could result in benefit cuts and higher costs for 35 million seniors and people with disabilities when they renew their Medicare Advantage coverage in October 2026.

What does that mean in practice? Most Medicare Advantage plans today offer dental, vision, and hearing benefits at no extra cost.

Plans already cut some perks for 2026: meal delivery dropped from 65% of plans in 2025 to 57% this year, and over-the-counter allowances fell from 73% to 66%.

Expect steeper cuts in 2027. Some insurers may also exit less profitable markets entirely, shrinking choice for rural seniors.

How CMS’s ‘accuracy fix’ could hit seniors

CMS Administrator Mehmet Oz framed the decision as technical and corrective.

By strengthening payment accuracy and modernizing risk adjustment, CMS is helping ensure beneficiaries continue to have affordable plan choices and reliable benefits while protecting taxpayers from unnecessary spending.

The specifics center on eliminating “unlinked chart review records,” diagnoses insurers find by auditing old medical charts, rather than from direct patient encounters.

CMS says this practice artificially inflates how sick enrolees appear, driving up payments. Removing it cuts payments by 1.53%.

The catch is that industry groups actually support the chart review policy.

The Alliance of Community Health Plans agreed it’s “a welcome step.” But they called the overall rate flat “disappointing and wholly unrealistic as medical costs and acuity continue to rise.”

The math doesn’t work. Even agreeing that some diagnoses were overstated, plans need revenue growth to cover real medical inflation and labor costs. Instead, they are getting a freeze.

Humana bore the worst brunt; the company derives roughly half its revenue from Medicare Advantage, but all major insurers face margin pressure.

Wall Street will lobby hard through a February 25 comment period, with CMS issuing final rates by April 6.

But unless the Trump administration shifts course, seniors should expect leaner benefits this fall.

The post Medicare shock: health insurers could cut benefits for 35M seniors in 2027- here’s why appeared first on Invezz