Micron stock (NASDAQ: MU) has already been one of the biggest winners of the AI boom as demand for advanced memory chips exploded.

Yet a growing group of analysts now argues the real surprise may still lie ahead.

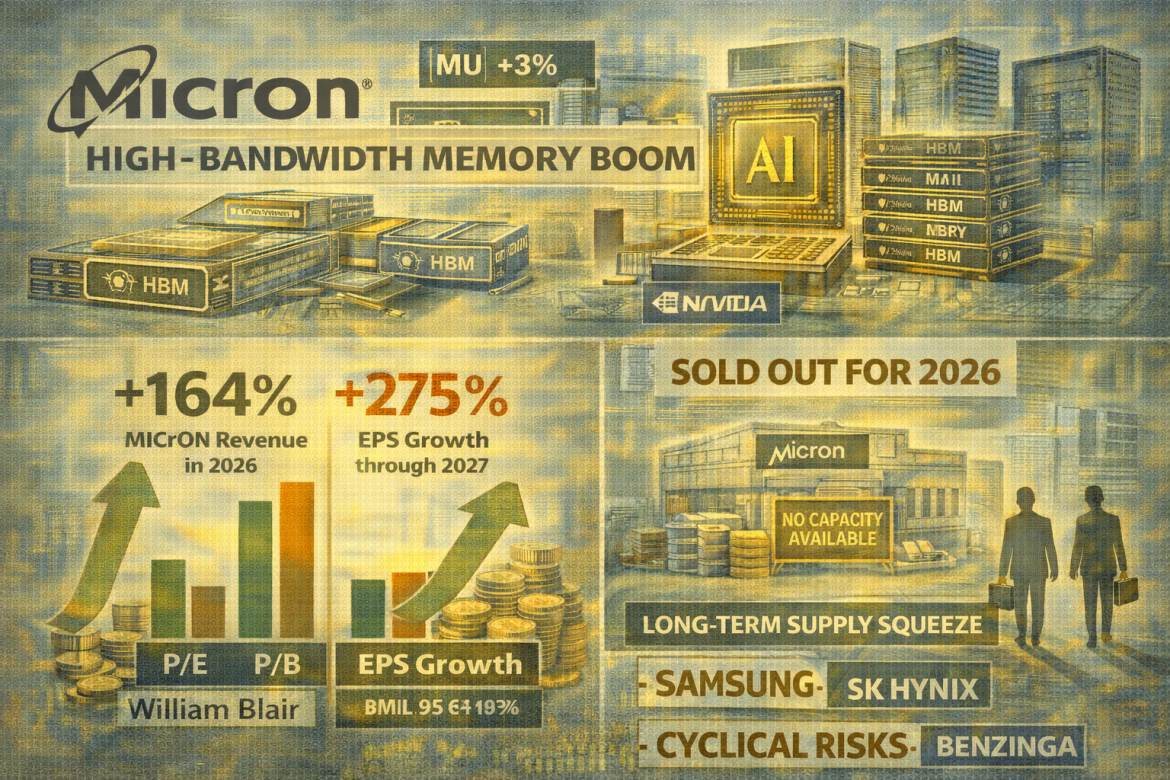

Their thesis is based on Micron’s sudden clout in high-bandwidth memory (HBM), the specialist memory chips that sit next to AI processors, which is setting up a 2026 earnings shock that many investors still have not priced in.

Sold‑out HBM and AI memory supply squeeze

HBM is a form of ultra‑fast, stacked memory that sits close to AI chips from Nvidia and others, feeding them data at very high speeds.

It is more complex to make than traditional DRAM and consumes more factory capacity, which means each bit of HBM effectively displaces several bits of standard memory on a production line.

In an AI server, making HBM is as critical as the accelerator chip itself.

Micron’s management told investors on its latest earnings call that it has “completed agreements on price and volume for our entire calendar 2026 HBM supply,” including its next‑generation HBM4 products.

Executives have also said the company is “completely sold out for 2026,” echoing commentary that AI‑related memory is booked well ahead of time.

William Blair’s Naji leans heavily on that constraint, telling clients Micron’s HBM production for 2026 is already sold out, a key reason for his bullish view.

New capacity is coming, but mostly too late to loosen the near‑term squeeze. Micron is building two new fabs in Boise, Idaho, scheduled to ramp around 2027–28, and a much larger complex in New York due near the end of the decade.

Wall Street’s upside: profits, pricing and a longer cycle

On the numbers, William Blair’s initiation lays out an aggressive version of the upside story.

Naji estimates Micron’s HBM revenue could jump 164% in 2026 and another 40% in 2027 as AI servers absorb more memory per rack and HBM takes a bigger slice of the bill of materials.

Combined with tight supply and richer product mix, that growth leads him to forecast that Micron’s adjusted earnings per share could rise more than 275% over the next two years.

For a stock still trading at roughly 11–12 times his 2026 earnings estimate, below Micron’s historical average multiple , that kind of earnings ramp implies room for upside if the cycle plays out as he expects.

Crucially, Micron’s own guidance backs the idea that this is not a short, one‑off spike.

On its fiscal Q1 2026 call, CEO Sanjay Mehrotra said strong AI‑driven demand and supply constraints are creating “tight market conditions,” and that the company expects those conditions “to persist beyond calendar 2026.”

He also warned that aggregate industry supply is likely to remain “substantially short of demand for the foreseeable future,” pointing to a structural shortage rather than a typical memory boom‑and‑bust.

There are clear risks. Samsung is racing to close the gap in HBM, recently qualifying its advanced HBM3E chips for Nvidia platforms and leaning on deep relationships with hyperscalers like Google.

SK Hynix remains the market leader and could defend its share more aggressively as new generations of HBM roll out.

But for now, the setup is unusual for a sector known for violent cycles: demand visibility through at least 2026, sold‑out HBM lines, and a major broker telling clients that profits could almost quadruple from here.

The post Why Wall Street thinks this AI stock could be 2026’s biggest surprise appeared first on Invezz