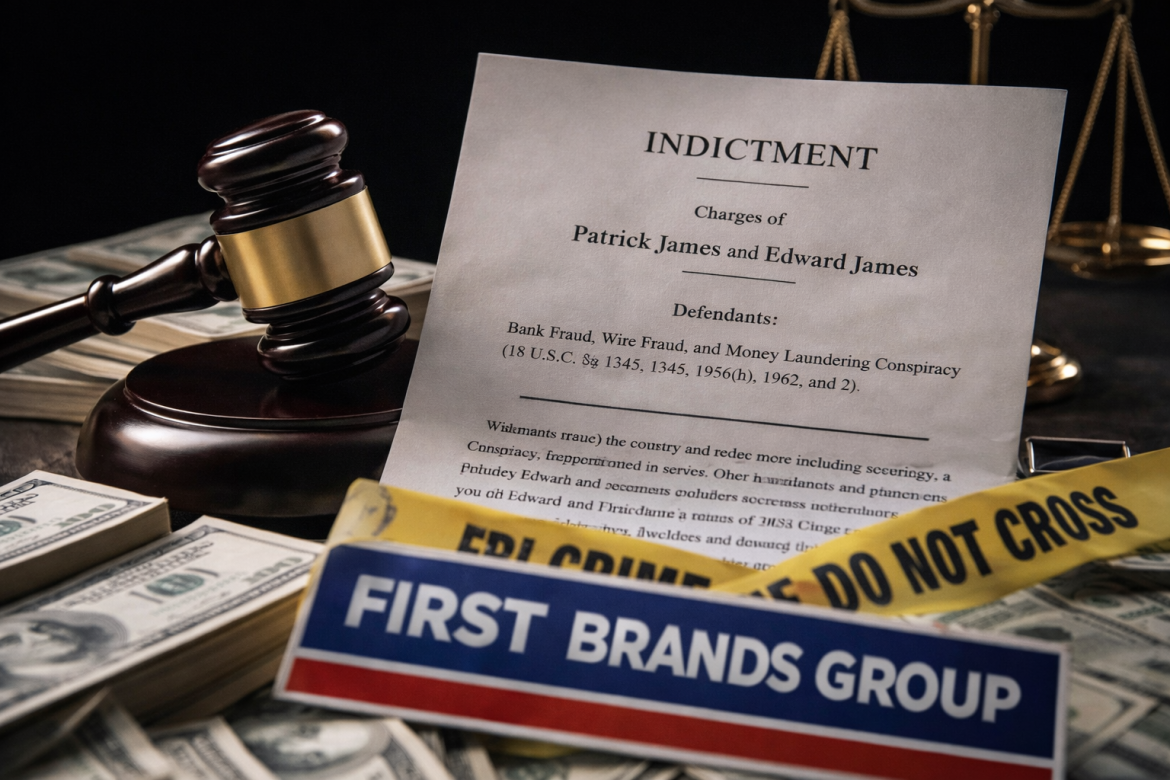

Federal prosecutors in New York have charged First Brands Group founder Patrick James and his brother Edward with orchestrating an alleged scheme to defraud lenders of billions of dollars, marking a dramatic escalation in the collapse of the auto parts company.

The indictment, unsealed on Thursday in Manhattan federal court, accuses the brothers of running a series of fraudulent schemes that misled lenders and financing partners while enriching themselves, according to court filings.

Allegations of systematic deception

Prosecutors allege that Patrick and Edward James engaged in a wide-ranging pattern of financial misconduct, including inflating invoices, repeatedly pledging the same collateral to multiple lenders, falsifying financial statements, and concealing significant liabilities.

The indictment charges the brothers with nine criminal counts, including operating a continuing financial crimes enterprise, bank fraud, wire fraud, and conspiracy to commit money laundering.

Prosecutors said the alleged schemes generated billions of dollars in financing for First Brands and yielded millions of dollars in personal proceeds for the defendants.

Neither man has publicly responded to the charges, and it remains unclear how they plan to plead.

From acquisition spree to collapse

First Brands traces its origins to Crowne Group, an Ohio-based company that Patrick James transformed into a global automotive aftermarket business through a series of acquisitions.

After acquiring brands such as Trico, known for windshield wipers, James rebranded the group as First Brands in 2020 and accelerated its expansion through debt-funded deals.

The strategy ultimately unravelled last year when First Brands filed for Chapter 11 bankruptcy protection in Texas on 29 September.

The company cited mounting creditor concerns over opaque off-balance-sheet financing practices, listing liabilities of between $10 billion and $50 billion against assets of between $1 billion and $10 billion.

In November, First Brands filed a lawsuit against Patrick James and others, alleging that fraud had left the company saddled with at least $2.3 billion in liabilities.

Around the same time, the US Securities and Exchange Commission opened an investigation into Jefferies Financial Group, examining whether the bank adequately disclosed its exposure to First Brands during the collapse.

Restructuring pressures and fresh funding talks

The legal fallout comes as First Brands attempts to stabilise its operations amid bankruptcy proceedings.

Earlier this week, the company announced plans to scale back certain US operations, including its Brake Parts and Autolite brands, signalling efforts to preserve cash and streamline its business.

Separately, the Financial Times reported that Ford and General Motors are in talks with First Brands on a potential financing arrangement that could provide liquidity during the restructuring.

Under the proposed deal, the automakers would pay in advance for parts they expect to receive from the company.

Sources familiar with the discussions told FT that the negotiations are nearing completion, though the deal could still fall apart.

Talks have intensified in recent days as the parties seek to finalise terms that would help keep First Brands operating through Chapter 11.

The post US prosecutors charge First Brands founder and brother in alleged lender fraud scheme appeared first on Invezz